UNITY within the COMMUNITY

THE APPROVED 2024 BUDGET FOR PIERCE COUNTY

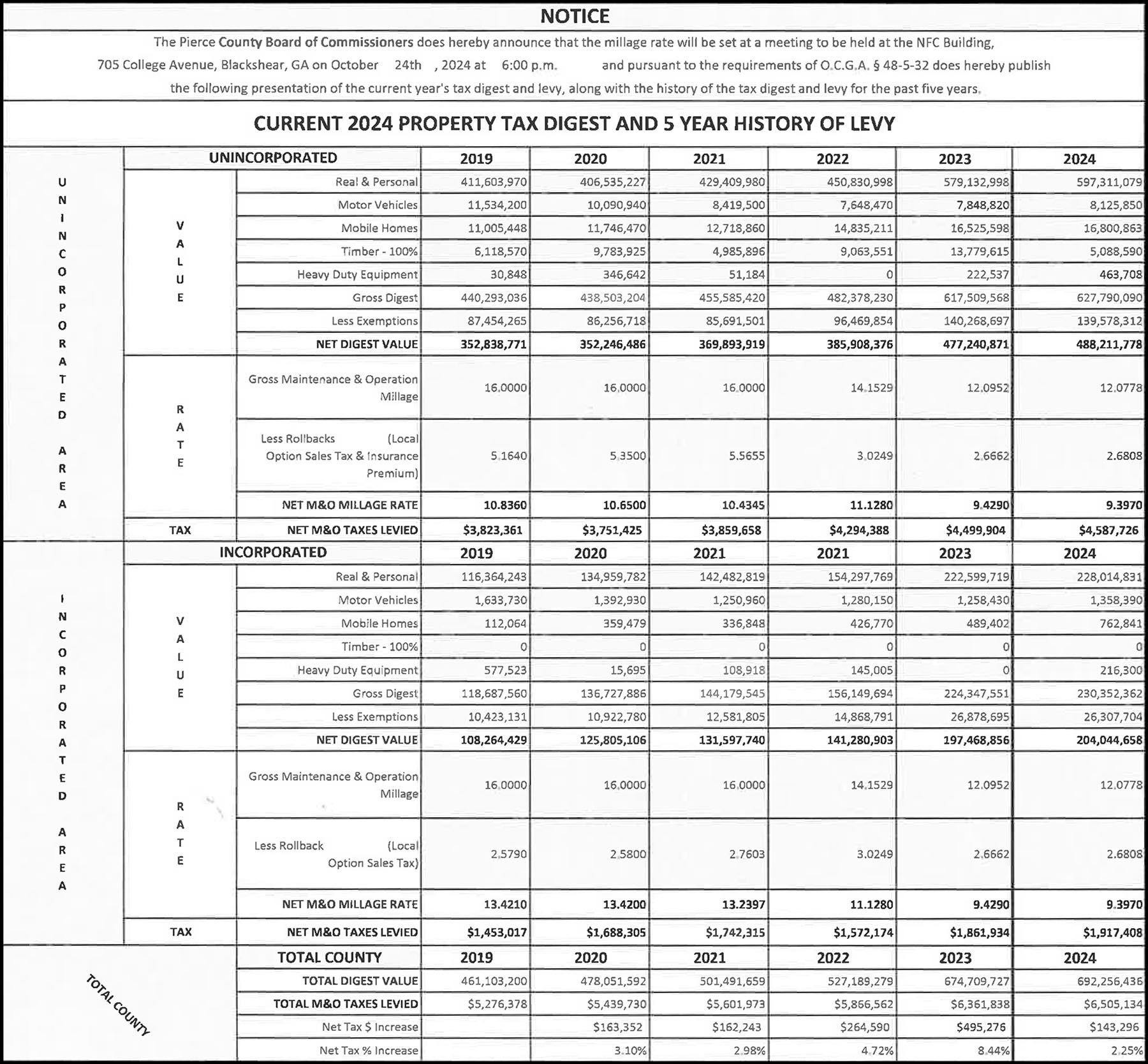

2024 CURRENT TAX DIGEST & 5 YEAR HISTORY OF LEVY

Disaster Relief funding

Due to the recent damage to personal and business property as a result of Hurricane Debby, Pierce County EMA is gathering data from its residents and business owners to apply for FEMA Disaster Relief funding.

FLOOD UPDATE

FLOOD WARNING NOW IN EFFECT UNTIL THIS EVENING

A Flood Warning was issued from August 12 at 8:36 AM EDT until August 12 at 8:00 PM EDT by NWS Jacksonville FL

…The Flood Warning is extended for the following rivers in Georgia…

Satilla River At Waycross affecting Ware and Pierce Counties.

Additional information is available at www.water.weather.gov/wfo/JAX

* WHAT…Minor flooding is occurring and minor flooding is forecast.

* WHERE…Satilla River at Waycross.

* WHEN…Until this evening.

* IMPACTS…At 16.0 feet, Flooding of agriculture and timberlands begins. On the Ware County side, the Jamestown Road Boat Ramp is flooded. On the Pierce/Brantley county line at the State Road 121 Bridge the boat ramp and dirt access roads are flooded. At 17.0 feet, On the Ware County side, the Jamestown Road Boat Ramp parking lot and access road is flooded and Simmons Trail is flooded cutting off one residence. On the Pierce County side, the Okefenokee Country Club Course Holes 14 through 16 begin to flood.

At 18.0 feet, On the Pierce County side, the Okefenokee Country Club Golf Course is generally closed. Riverwoods Drive low lying properties begin to flood.

* ADDITIONAL DETAILS…

– At 7:45 AM EDT Monday the stage was 16.2 feet.

– Forecast…The river is expected to fall below flood stage this afternoon and continue falling to 13.8 feet Thursday morning.

– Flood stage is 16.0 feet. – www.weather.gov/safety/flood

Welcome to Pierce County

Thank you for visiting the Pierce County, Georgia, website. Pierce County is nestled in southeast Georgia and provides residents and visitors with a beautiful rural atmosphere year-round. Whether blooming with the promise of spring or set ablaze with the colors of fall, the beautiful farmland and small-town atmosphere that make up our county are a sight to behold and are full of natural wonders to be discovered. The Alabaha River takes a winding course through the county, creating wonderful fishing and plenty of opportunities for outdoor entertainment. A peaceful small-town atmosphere offers a haven from the hustle and bustle of contemporary life, and the sense of community here is as old and as strong as the land itself.

We have friendly, hardworking residents who are proud of their heritage while looking toward the future with hope and initiative. Whether you are looking for a scenic place to visit, a hometown in which to raise a family or a willing community in which to locate a business, you are welcome in our county.

So come visit one of our many churches, go fishing, explore the history of the ‘ole Okefenokee, or take a scenic drive across our country roads. We hope to see you and “Welcome” home. from your PIERCE County Board of Commissioners

Visit the QPublic website

for things such as: Search Records, Tax Estimates, and Forums YOU WILL BE TAKEN AWAY FROM THIS WEBSITE

Called Meeting

We will have a Called Meeting on October 14, 2024, at 6:00 PM,PLEASE NOTE the change of date, it will now be October 15, 2024, at 6:00 PMat the NFC Building to discuss and approve the mileage rate....

Logic and Accuracy (L&A) Testing

Logic and Accuracy (L&A) Testing will begin Tuesday, September 24, 2024 at 10:00 a.m. and the Pierce County Elections Office located at the County Annex Courthouse, 312 Nichols Street, Blackshear,...

Board of Elections will be meeting

The Pierce County Board of Elections will be meeting at the Courthouse Annex at 312 Nichols Street, Blackshear, Ga., on October 2, 2024 at 9:00 a.m. MATT GARDNERPIERCE COUNTY BOARD OF...

Some images on this website are courtesy of

local photographer Wayne Morgan

Contact Us

Contact Us

Physical address:

312 Nichols Street,

Blackshear, GA 31516

t: 912.449.2022

f: 912.449.2024

E-Verify Authorization

Number: 72031 | Date: 12/06/2007.

About Pierce County

Pierce County, established in 1857 and named for President Franklin Pierce, grew out of Appling and Ware counties' lands.

The county seat, Blackshear, bears the name of General David Blackshear who fought Indians in Georgia and Florida during the War of 1812.

Board of Commissioners

We appreciate your interest in Pierce County, Georgia, and hope this site proves useful in providing information about the Board of Commissioners, local government, and our community. Should you have questions, please contact us at: 912.449.2022.

Georgia Bureau of Investigation

Georgia Bureau of Investigation

Human Trafficking Notice | click here